CBS News – The epic meltdown in energy prices has more recently been taking a bit of a breather.

Just look at gasoline, which collapsed nearly 61 percent from its high last summer to the low in January before reversing and zooming higher, climbing 61 percent earlier this month. Crude oil rebounded as well: West Texas Intermediate (WTI) jumped 24 percent from $43.58 a barrel to a high of $53.99 in early February.

But the evidence is building that another bout of weakness is about to hit energy prices — with mixed benefits to consumers, the economy and stocks.

For gasoline, the rebound was fueled by a combination of factors, including the largest refinery strike in 35 years — affecting a fifth of the country’s capacity — as well as a refinery fire in California and seasonal formulation changes and refinery maintenance shutdowns.

On Thursday, United Steelworkers union, which represents the refinery workers, said it had reached a tentative deal with Shell Oil (RDS.A) after a month of tough negotiations. The final deal will need to be voted on, but the end of this saga appears in sight.

As a result, the United States Gasoline Fund (UGA) tested below its 50-day moving average on Friday for the first time since early February and is already down nearly 14 percent from its recent highs. Adding further downward pressure is the renewed selling that’s hitting crude oil. WTI fell below the $47.50-a-barrel support level that’s held the black stuff aloft since late January. A retest of the lows near $43 a barrel looks likely.

A number of catalysts are in play here.

For one, a series of strong readings on the U.S. job market has sent the dollar soaring on expectations the Federal Reserve will lay the groundwork in its March 18 policy statement and economic forecasts for an interest rate hike as soon as June — which would be the first since 2006.

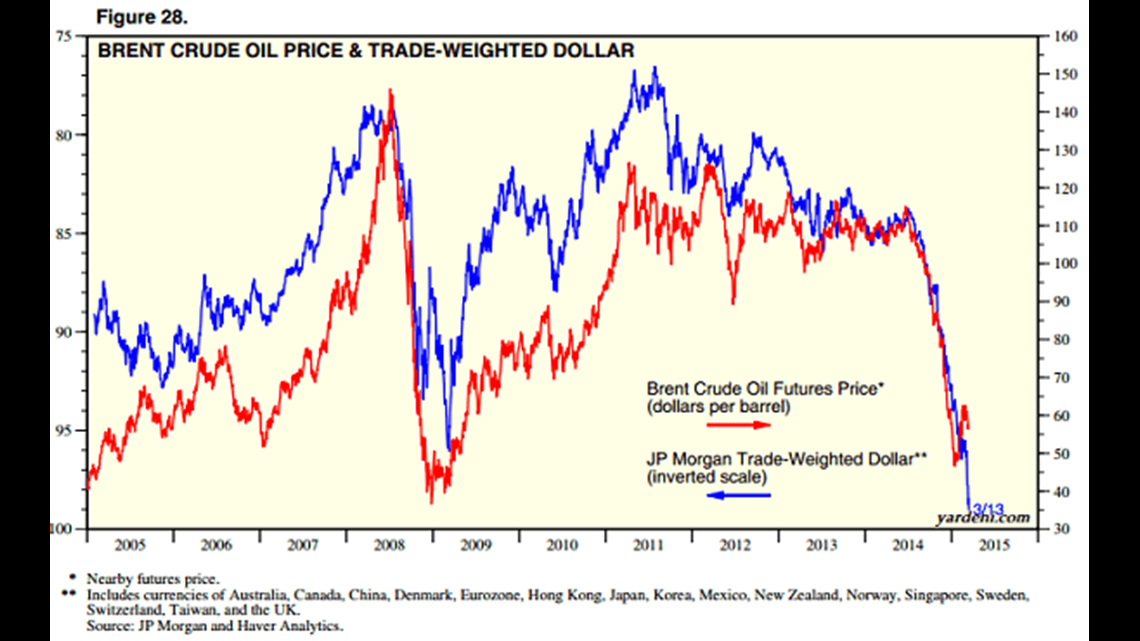

Because oil and other commodities maintain an inverse relationship with the greenback — through which most global oil transactions are denominated — the dollar’s strength is generating new weakness in crude. You can see this relationship in the chart above from Yardeni Research, which suggests that the dollar’s rise (shown in an inverted scale here) should push oil prices down by roughly one-third in the days to come.

Two, weakness in measures like factory orders and retail sales has pushed down the Federal Reserve Bank of Atlanta’s GDPNow real-time estimate of first-quarter GDP growth to just 0.6 percent. Combined with ongoing economic stalling throughout Asia and Europe, it indicates that global energy demand remains tepid.

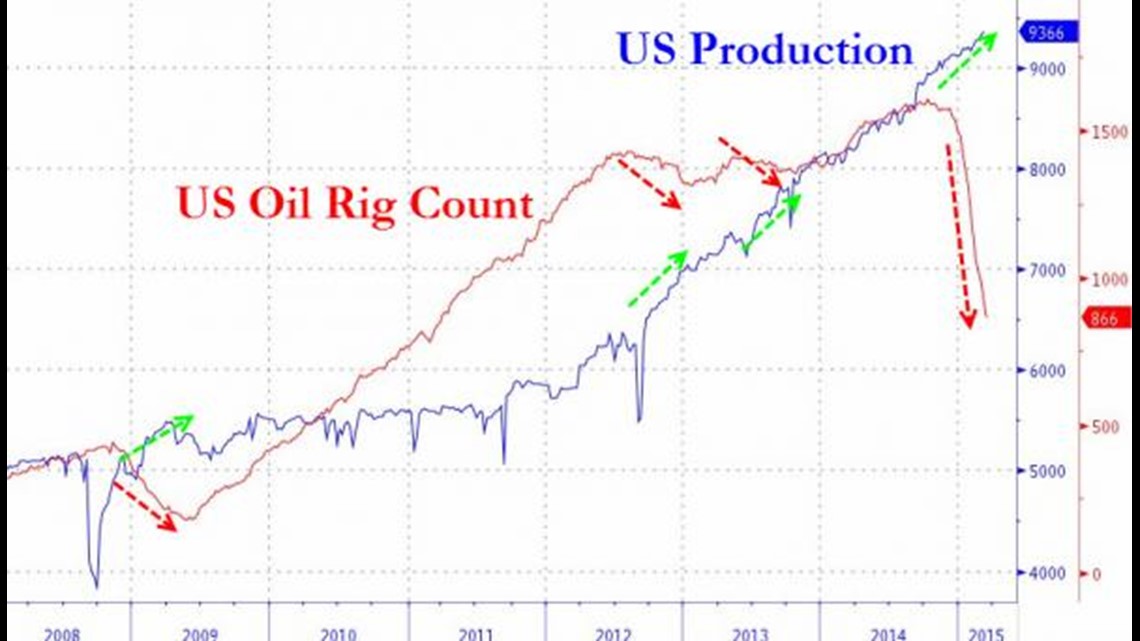

Three, despite another drop in the U.S. drilling rig count (the 14th week in a row and at the fastest rate in 29 years), U.S. oil production continues climbing to new highs, as shown above. Inventories have swelled to levels not seen since the 1930s, filling onshore tanks to about 60 percent of capacity (vs. 48 percent at this time last year) according to the U.S. Energy Information Administration.

As things stand now, Bloomberg estimates that onshore storage will hit capacity sometime in June — at which time a flood of supply could pour into the cash oil market, pummeling prices.

I don’t know about you, but I’m going to enjoy watching the prices at the corner gas station start creeping lower again — tick by tick — in the days and weeks to come. And for American consumers, who just posted their first consecutive three-month decline in retail sales since the recession, the extra savings could help reinvigorate spending and help GDP growth rebound in the second quarter and beyond.

The need for even deeper cuts to the U.S. rig count and the inevitable top-line impact to energy producers will mean more pain for energy sector stocks like Exxon Mobil (XOM) and Chevron (CVX). Both companies saw their shares drop out of multimonth trading ranges this week to return to levels last seen in 2013. Beyond energy companies, overall corporate earnings growth and business investment will feel a pinch.

Reality will hit when these companies start reporting first-quarter results at the end of April.