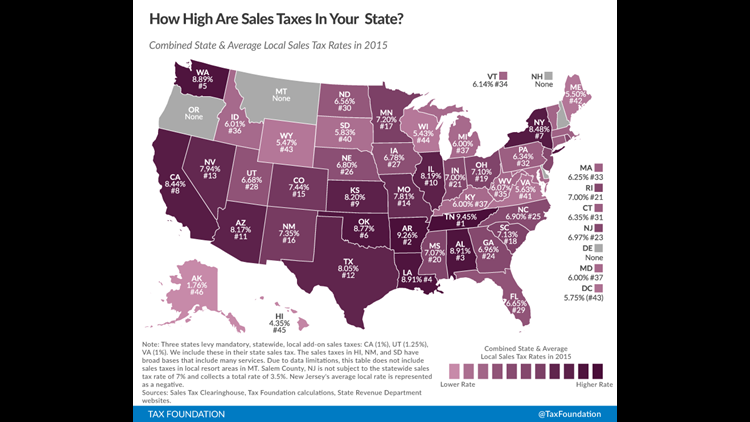

ARKANSAS (KFSM) – Arkansas has the second-highest combined state and local sales tax in the country, according to a report from Tax Foundation.

The report, published on April 8, analyzed local sales tax rates and state sales tax rates across the country at the start of 2015. The Arkansas state tax rate is 6.5 percent, and the average local tax rate is 2.76 percent, adding up to a combined total of 9.26 percent, the report states.

The combined rate is second only to Tennessee, which has a combined tax rate of 9.45 percent, according to Tax Foundation.

A total of 45 states in the U.S. collect statewide sales taxes, and 38 collect local sales taxes, the report states.

Oklahoma placed at number six on the list with a combined tax rate of 8.77 percent, according to Tax Foundation.

Four states tied for the lowest combined tax rate, and they were:

- Delaware

- Montana

- New Hampshire

- Oregon

None of the above-named states have a local or state sales tax, according to the report.

The Tax Foundation describes itself as a “nonpartisan research think tank, based in Washington, D.C.” They’ve been analyzing tax policy since 1937, their website states.

To read the full report, click here.