GRAVETTE (KFSM) -- Administrators at the Gravette School District are asking voters within the district's boundaries to approve a 2.5 mill increase for building improvements during the primary election May 22.

Superintendent Richard Page said growth has created the need for improvements within the district.

"'Over the last seven or eight years, we're seeing about a couple hundred students that have come into our district and that's not going to change," Page said. "We're going to continue to see that growth."

If approved, the $12.8 million in bonds would go to four different projects, with the district chipping in an additional $1 million toward the cost.

The first of the proposed projects include a $447,000 remodel of Glenn Duffy Elementary, which among other items, includes relocating the office to the front of the building and adding air conditioning to the gymnasium.

A second project includes renovating Gravette Middle School for nearly $961,000, and would add a vocational classroom, as well as a foreign language class.

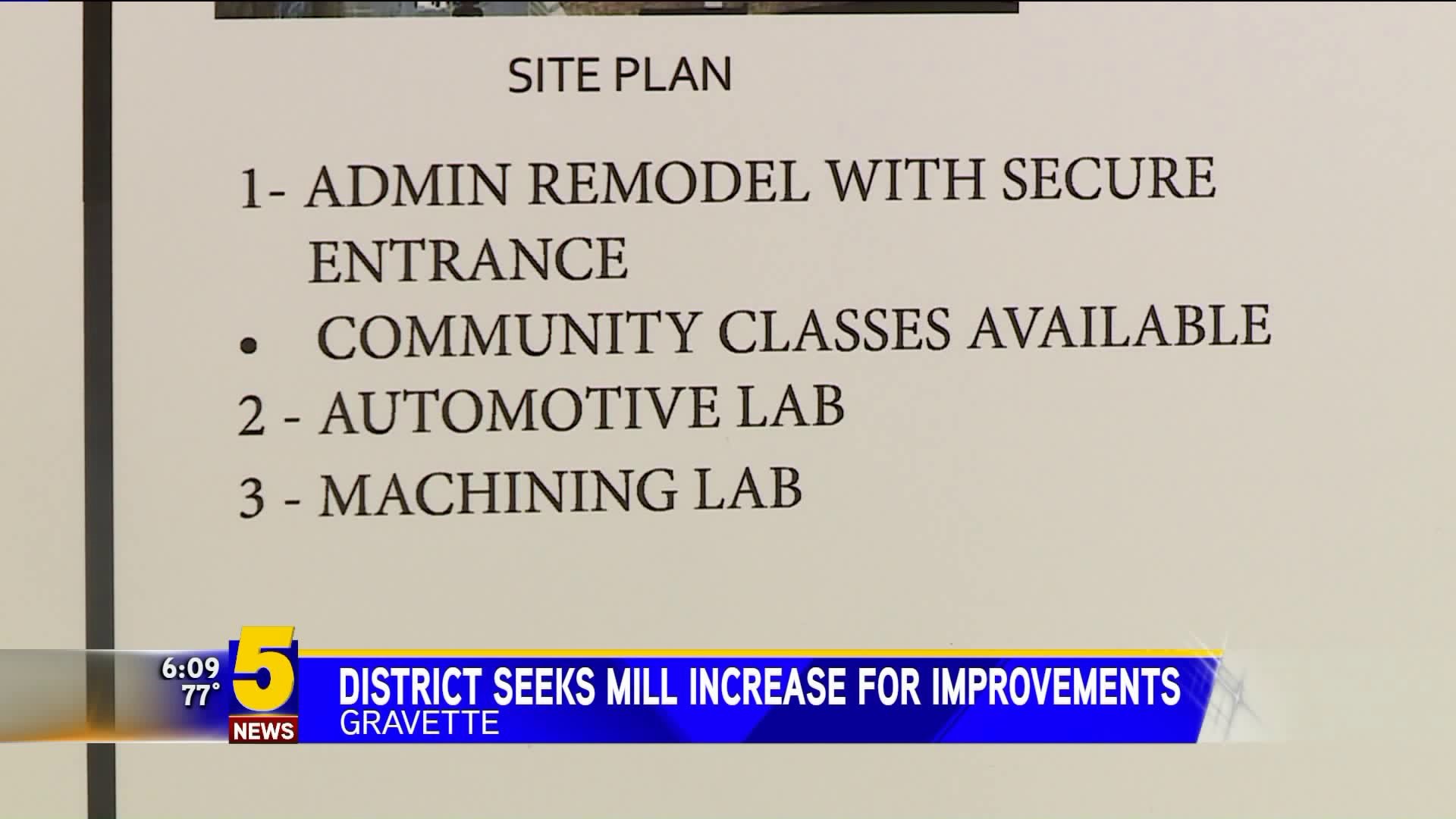

Among other proposed tasks include building a $1.5 million addition to the Career Center to house automotive service technology and machining classes. Page said adult training classes would also be added.

The largest of the projects include the construction of a new gymnasium at Gravette High School with a price tag at just over $9 million. You can read more on the proposed project, here.

Gravette School District voters last approved a tag increase in 2006. Eight years later, another proposal was soundly shot down by voters.

Melissa Flippo, who has a 9-year-old son in the district, said she supports the increase and hopes others will see the value.

"These kids are our future, and whether it's sports or academics, we just want to be behind them," Page said. "We want them to have the best and compete with everyone else."

The additional 2.5 mills would increase the rate to 39.7 mills, remaining the lowest in Benton County. For homeowners, it would cost another $50 a year per $100,000 of assessed property value.

Page said the cost to do the projects is not getting any cheaper, and that the time to act is now.

"Everybody likes low taxes," Page said. "But there are also things you get when you do raise taxes, and the quality of life is one of those things you get from it."