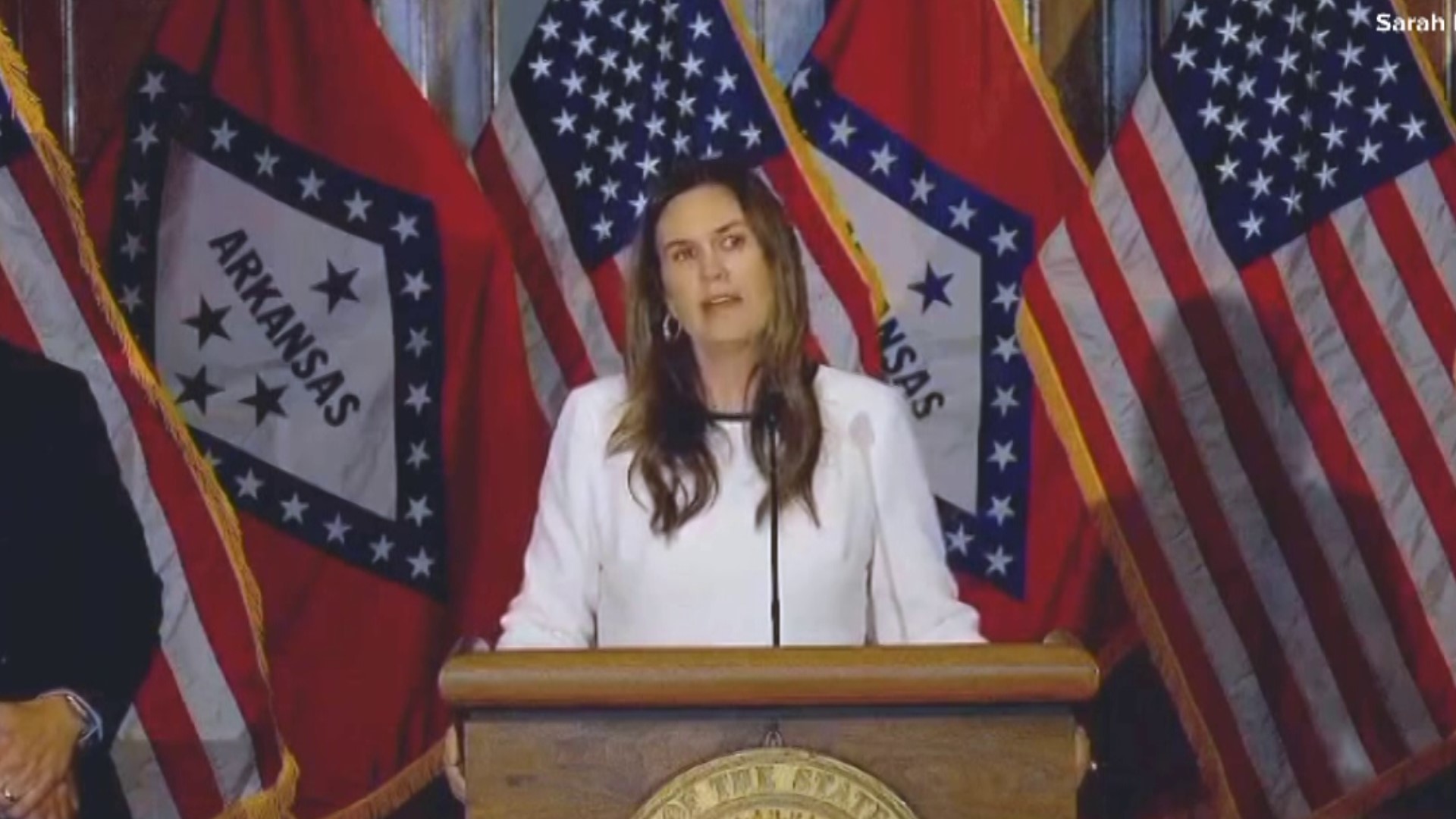

ARKANSAS, USA — Arkansas Governor Sarah Huckabee Sanders announced on Friday lawmakers in the state will return to Little Rock for a special session. Before the official announcement, State Senator Bart Hester from Cave Springs said the session's main topics would involve efforts to lower individual and corporate income taxes, and changes to the Freedom of Information Act (FOIA).

Arkansas is one of 14 states where a special session can only be called by the governor. There are many reasons why a governor would call for a special session, but essentially, it gives the state leader a chance to pass specific measures or policies that weren't covered or didn't pass during the regular session.

The Arkansas General Assembly (state representatives and state senators) meets on the second Monday of every other year. Usually, these sessions last for two months unless lawmakers vote to extend it. The last session began in January 2023 and ended in May.

Tax Cuts

During her announcement of the special session, Sanders said that tax cuts would be the main priority.

“We are continuing to have surpluses … We're taking too much from the taxpayer … We want to send some of that back,” Sen. Hester said. These possible cuts are on the heels of a bill signed in April by Gov. Sanders that cut taxes from 4.9% to 4.7% for 1.1 million taxpayers who make more than $24,300 a year in the state.

Sanders made campaign promises of phasing out the state's income tax altogether.

Back in July, the governor said the state's over $1 billion surplus could be used to "responsibly phase out the state income tax." That surplus is the second largest in the state's history, according to the Department of Finance.

House Bill 1001 proposed the following changes to individual income taxes:

- Net income $5,099 or less: 0% tax rate

- Net income between $5,100 and $10,299: 2% tax rate

- Net income between $10,300 and $14,699: 3% tax rate

- Net income between $14,700 and $24,299: 3.4% tax rate

- Net income between $24,300 and $87,000: 4.4% tax rate

For individuals who make more than $87,000:

- $0-$4,400: 2% tax rate

- More than $4,400: 4.4% tax rate

For corporate income taxes, the following changes were proposed:

- On the first $3,000 of net income, 1% is taxed

- On the next $3,000 of net income, 2% is taxed

- On the next $5,000 of net income, 3% is taxed

- On net income exceeding $11,000, 4.8% is taxed

In addition to the tax cuts, there is a plan to offer a $150 tax credit to Arkansans making less than $90,000 annually.

To read the full proposed bill, click here.

Freedom of Information Act (FOIA)

Sanders said that she plans to revise the state's FOIA laws, claiming they are being "weaponized." This comes on the heels of a lawsuit filed in early September against the Arkansas State Police, accusing the agency of withholding public records requested in relation to Sanders' travel and security.

Matthew Campbell filed the lawsuit after ASP wouldn't turn over requested communications and travel records for the state police plane that the governor uses for travel. ASP claimed the documents were considered "personnel records" and would grant an unwarranted invasion of privacy, according to the lawsuit.

"It's a new low in Arkansas politics for some on the radical left to weaponize FOIA and put the governor's and her family's lives in danger," Alexa Henning, a spokeswoman for Sanders, said in a statement.

Sanders said the special session will be used to update sections of the FOIA law so that the sources and methods used by Arkansas State Police to "protect" her and her family "are not subject to disclosure."

The bill filed ahead of the special session does explicitly exempt "records that reflect the planning or provision of security services provided to the Governor" from being requested under FOIA.

Also included in exemptions from FOIA:

- Records revealing the deliberative process of state agencies, boards, or commissions including:

- Executive branch memos or letters between or within the state agency

- Communications and documents reflecting advisory opinions

- Recommendations

- Deliberations that comprise part of the process by which governmental decisions and policies are formulated

- Records prepared by an attorney representing an elected or appointed state officer for use in pending litigation

- Records created or received by an elected or appointed state officer, state employee, etc. that would be privileged under the "attorney-client privilege" rule, or rule 502(b) of the Arkansas Rules of Evidence

- Executive branch memos or letters between or within the state agency

If passed, the law would be retroactive to have begun on January 1, 2022.

To read the full bill proposed, click here.

COVID-19 vaccine mandate

Another bill filed to be discussed during the special session involves prohibiting the state government from requiring COVID-19 vaccines, or vaccine mandates.

House Bill 1002 proposes that the state, a state agency or entity, a political subdivision of the state, or a state or local official shall not mandate or require an individual to receive a vaccine or immunization for COVID-19 or any of the subvariants of COVID-19.