ARKANSAS, USA — The Associated Press is reporting that voters in Arkansas have chosen to not legalize recreational marijuana in the state.

Arkansas Issue 4 was the only citizen-proposed measure on the 2022 ballot, meaning that it garnered Arkansas residents' signatures in order to get in front of voters on the 2022 ballot. The other three issues were introduced by state lawmakers.

Just a few years after medical marijuana was legalized in the Natural State, the proposal to change the state's constitution to include recreational marijuana has drawn reactions from opponents and supporters of legalization.

What exactly is Issue 4?

The exact wording of the issue on the ballot:

ISSUE NUMBER 4

An amendment to authorize the possession, personal use, and consumption of cannabis by adults, to authorize the cultivation and sale of cannabis by licensed commercial facilities, and to provide for the regulation of those facilities.

Voting for the amendment means changing the state's constitution, authorizing the growing and selling of marijuana for non-medical purposes as well as:

- Giving existing medical marijuana growers and sellers licenses to grow and sell adult use of non-medical marijuana

- Authorizing 12 additional cultivation licenses and 40 dispensary licenses for adult use of marijuana

- Eliminating an existing sales tax on medical marijuana

- Introducing a sales tax on adult-use marijuana

- Eliminating a cap on how much THC can be in medical marijuana-infused drinks and food portions

- Making clear that lawmakers have no authority to change the amendment without another vote of the people

- Changing rules for businesses licensed to grow and sell marijuana in Arkansas

Voters have chosen to not legalize recreational marijuana in the state of Arkansas.

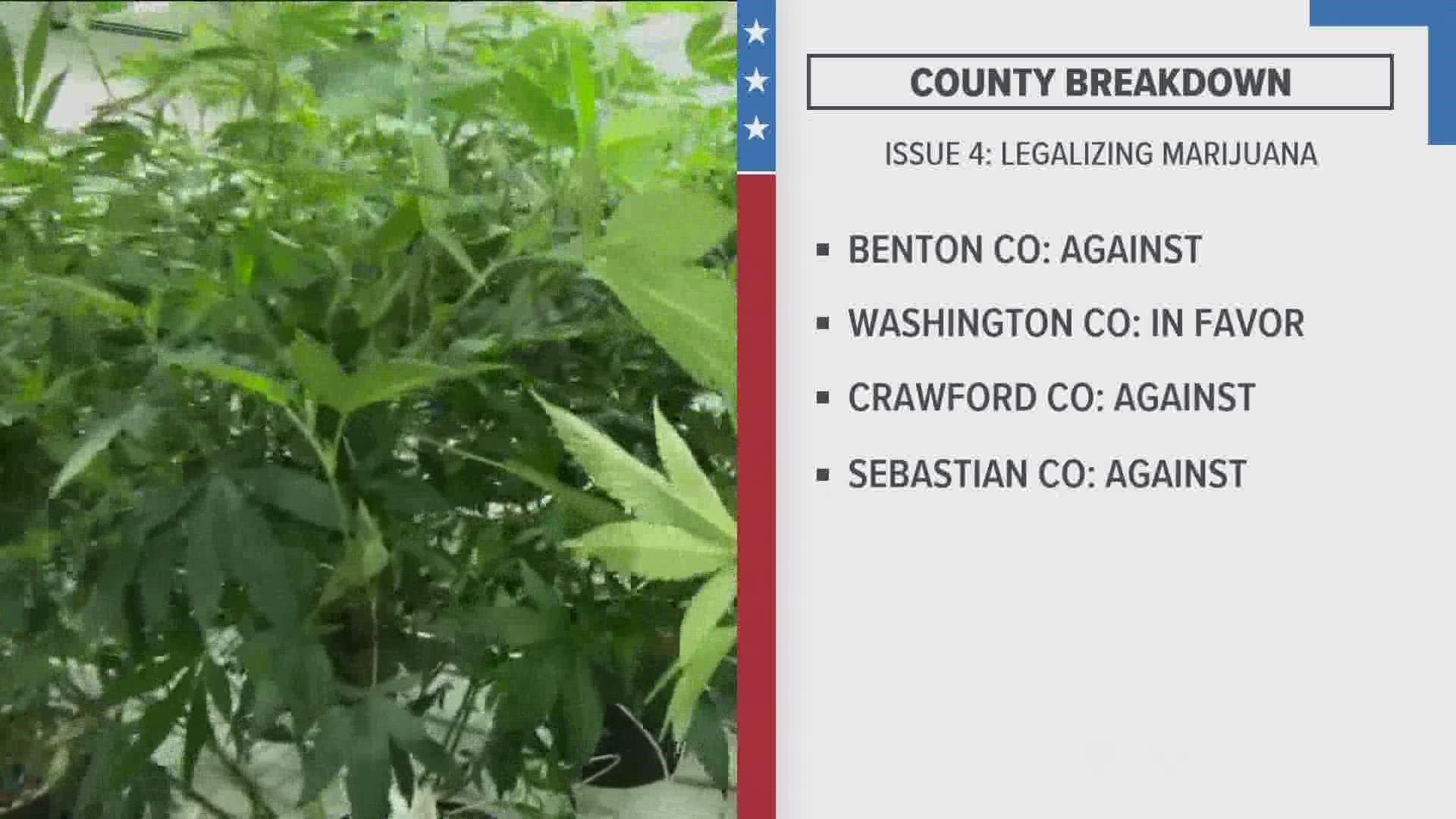

Local vote breakdown

- Benton County: Against (54% Against, 46% For)

- Washington County: For (48% Against, 52% For)

- Sebastian County: Against (53% Against, 47% For)

- Crawford County: Against (61% Against, 39% For)

Taxes on recreational marijuana

If the issue passed, existing taxes for medical use would be eliminated.

An economic impact analysis conducted for Responsible Growth Arkansas shows over a 5-year period receipts from that supplemental tax alone could total more than 303 million dollars.

The money from the supplemental sales tax would be split between law enforcement stipends, the University of Arkansas for Medical Sciences, and drug court programs.

Below is the breakdown of how the money would be split:

- 70% would go to the state's general fund to help pay for those overseeing the program and licenses

- 15% would go to pay a yearly stipend to law enforcement officers

- 10% will go toward UAMS

- The remaining 5% will be set aside to fund drug court programs

Over the five years that equates to a projected $212 million for the general fund, $45 million for law enforcement stipends, $30 million for UAMS, and $15 million for drug court.

According to the study, much of the potential economic impact would come from purchases by out-of-state consumers. Specifically, new tourists are expected to be attracted to vacation in Arkansas because of marijuana’s availability.

Download the 5NEWS app on your smartphone:

Stream 5NEWS 24/7 on the 5+ app: How to watch the 5+ app on your streaming device

To report a typo or grammatical error, please email KFSMDigitalTeam@tegna.com and detail which story you're referring to.