FAYETTEVILLE, Ark. — The Biden administration is moving toward a narrower student loan relief plan that would target specific groups of borrowers — those with soaring interest, for example — rather than a sweeping plan like the one the Supreme Court rejected in June.

The U.S. Education Department on Monday released a draft of new federal rules paving the way for a second attempt at student loan relief. The proposal targets groups that are seen as especially vulnerable, focusing on those who owe so much—or make so little—that they otherwise may never repay their loans.

Though full details are likely months away, the department says it wants to cancel some or all student debt for:

- Borrowers whose balances exceed what they originally owed

- Those who have loans that entered repayment 25 or more years ago

- Those who used loans to attend career-training programs that led to “unreasonable” debt loads or insufficient earnings

- Those who are eligible for other loan forgiveness programs, but did not apply.

A fifth group is also being discussed — those who are experiencing financial hardship that the current student loan system does not currently adequately address.

“President Biden and I are committed to helping borrowers who’ve been failed by our country’s broken and unaffordable student loan system,” Education Secretary Miguel Cardona said in a statement. “We are fighting to ensure that student debt does not stand in the way of opportunity or prevent borrowers from realizing the benefits of their higher education.”

Fayetteville financial advisor David Scoggins says the approval of this program could also be very beneficial to the economy.

"If we're able to help reduce the amount of student debt that's out there, it will almost act as a natural stimulus for the economy, where the borrowers that would have had these payments will now have more free cash flow to either save for retirement or go out and spend it. So I think it would just be a good thing all the way around," says Scoggins.

Scoggins says he thinks this proposal is so far the most realistic approach to a successful debt relief program and could be a step in the right direction toward alleviating a widespread issue.

"My primary client base is young professionals, ages 30 to 40. So, I work with a lot of people who have student loans. We find that a large part of the debt that they have currently in place is holding them back from potentially being able to purchase homes, or save for their future," said Scoggins.

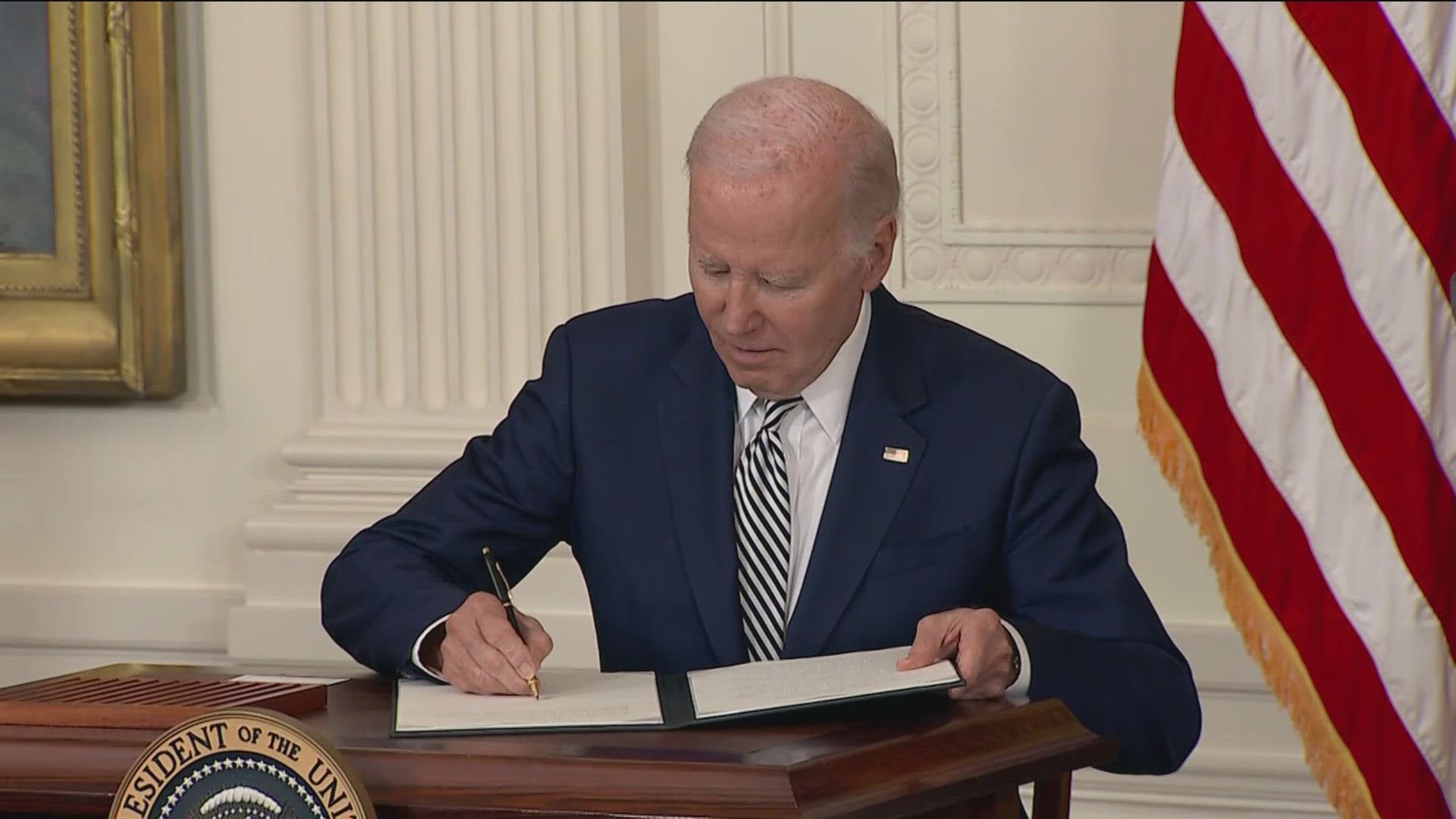

President Joe Biden’s initial plan was broader. It would have canceled up to $20,000 in federal student loans for those with annual incomes below $125,000, or couples below $250,000. But after that was rejected by the court’s conservative majority, he called on the Education Department to try again using a different legal basis.

The new proposal aims to tackle issues that are seen as some of the biggest culprits behind skyrocketing debt.

It would help counter interest that snowballs beyond borrowers’ original balances. It would offer relief to borrowers who attended for-profit college programs with poor outcomes. It would also help older borrowers who took out loans decades ago and struggle to make payments.

When asked about borrowers who attended for-profit college programs, Scoggins clarified that this portion of the proposal is speaking more to individual borrowers and specific departments within schools.

"A Harvard law graduate is probably going to make a higher salary than somebody who graduated from Harvard with an MBA in marketing, right? So, it's just one of those things where you understand when you go get that degree what your capacity for making income is. And I think that's where the program could potentially target those individual departments inside of the schools," Scoggins says.

For those who started repaying loans more than 25 years ago, the proposal says that “the secretary may waive the outstanding balance of a loan," amounting to total cancellation. It’s the same for borrowers who are eligible for other cancellation programs but haven’t applied.

Loans used to attend low-value college programs would also be wiped away. Borrowers would fall into that category if they attended a program that fails new standards outlined in a separate federal rule known as gainful employment.

For those with snowballing interest, the proposal would reset their loans back to the original balance, effectively canceling unpaid interest.

Even a more limited plan for relief is sure to draw fierce opposition from Republicans, who see cancellation as an unfair burden on taxpayers.

The latest attempt rests on the Higher Education Act of 1965, a wide-reaching law that gives the education secretary power to “compromise, waive or release” certain debts. But the law is unclear on how the secretary can wield that authority, creating a legal gray area that has been the subject of debate since Biden took office.

The proposal aims to settle the dispute by creating new federal rules detailing cases that merit cancellation. Before the rules can be enacted, they must be weighed by a committee of government outsiders in a process known as negotiated rulemaking. The new draft will be taken up when the committee meets next week.

The committee is made up of negotiators who represent a range of viewpoints on student loans. It includes students and officials from a range of colleges, along with loan servicers, state officials and advocates including the NAACP.

Meetings began earlier this month and are scheduled to continue into December.

At the end of the process, negotiators will vote on a proposed rule. If they reach consensus, the department will move forward with it. If they don’t, the agency will propose its own plan, which can be finalized after a public comment period.

The department says it will continue to refine the proposal as it goes through a federal rulemaking process. The public will be able to provide written feedback next year.

Parts of this story were contributed by the Associated Press.

Watch 5NEWS on YouTube.

Download the 5NEWS app on your smartphone:

Stream 5NEWS 24/7 on the 5+ app: How to watch the 5+ app on your streaming device

To report a typo or grammatical error, please email KFSMDigitalTeam@tegna.com and detail which story you're referring to.